Polymer Jetting 3D Printing for Microfluidic Device Fabrication in 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Leaders, and Growth Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Polymer Jetting for Microfluidics

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

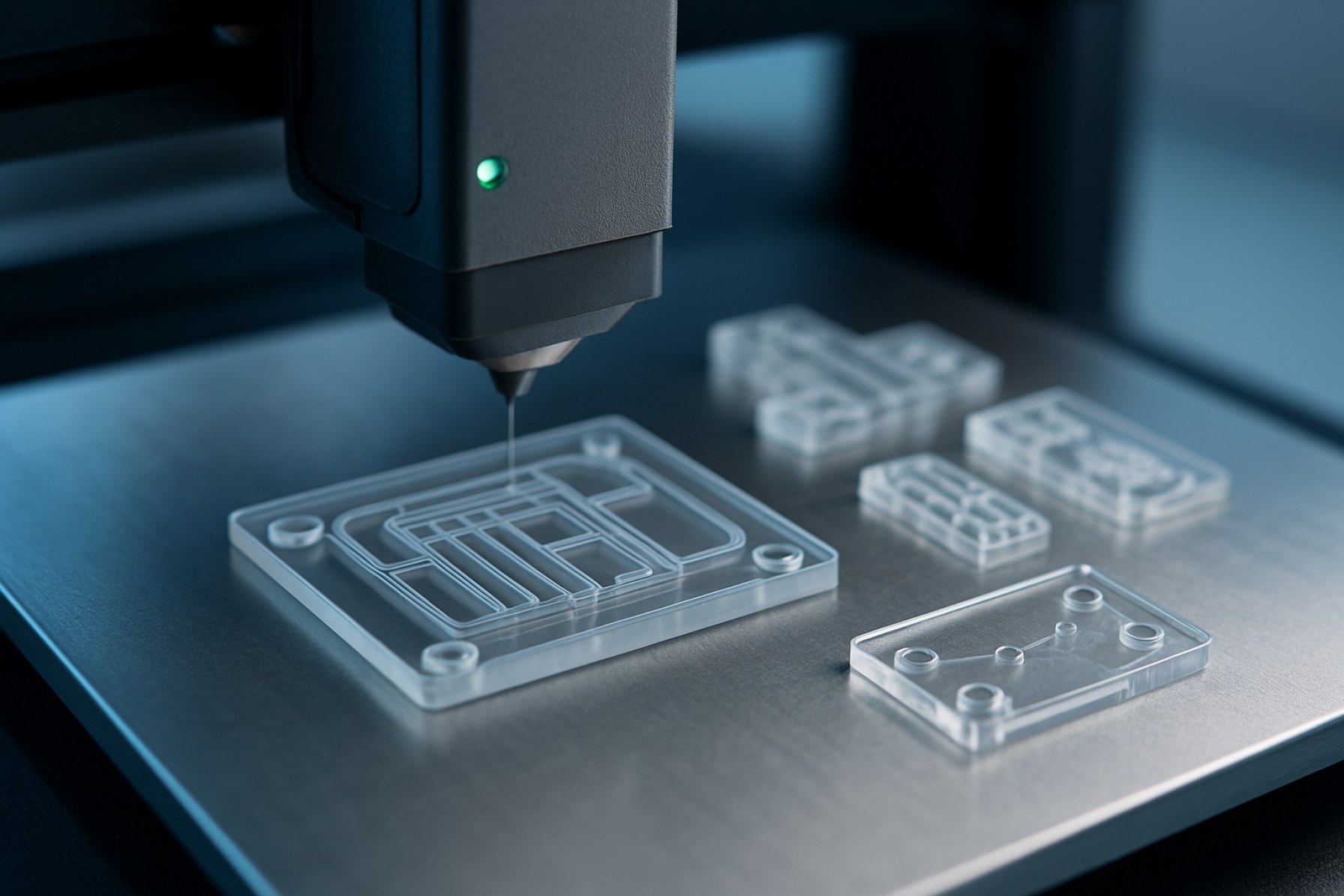

Polymer jetting 3D printing, also known as material jetting, has emerged as a transformative technology in the fabrication of microfluidic devices. This additive manufacturing process involves the precise deposition of photopolymer droplets, which are subsequently cured by UV light, enabling the creation of highly detailed and complex microstructures. As of 2025, the global market for polymer jetting 3D printing in microfluidic device fabrication is experiencing robust growth, driven by increasing demand for rapid prototyping, customization, and the miniaturization of analytical and diagnostic systems.

Microfluidic devices, which manipulate small volumes of fluids within microscale channels, are critical in applications such as point-of-care diagnostics, drug development, and environmental monitoring. Traditional manufacturing methods, such as soft lithography and injection molding, often face limitations in design flexibility, turnaround time, and cost-effectiveness for low-volume production. Polymer jetting addresses these challenges by enabling the direct fabrication of intricate geometries, integrated features, and multi-material constructs in a single build process.

According to SmarTech Analysis, the market for 3D printing in microfluidics is projected to surpass $500 million by 2027, with polymer jetting technologies accounting for a significant share due to their superior resolution and material versatility. Leading industry players, such as Stratasys and 3D Systems, have expanded their portfolios to include advanced polymer jetting platforms capable of producing transparent, biocompatible, and functional microfluidic components.

- Key growth drivers include the rising adoption of lab-on-a-chip devices in healthcare and life sciences, the need for rapid design iteration, and the push for decentralized manufacturing.

- Challenges remain in scaling up production, ensuring material compatibility with biological samples, and achieving regulatory compliance for medical applications.

- Geographically, North America and Europe lead in technology adoption, supported by strong research ecosystems and funding for biomedical innovation.

In summary, polymer jetting 3D printing is reshaping the microfluidic device landscape by offering unprecedented design freedom, speed, and functional integration. As the technology matures and material portfolios expand, its role in both prototyping and end-use device manufacturing is expected to grow, positioning it as a cornerstone of next-generation microfluidics.

Key Technology Trends in Polymer Jetting for Microfluidics

Polymer jetting 3D printing, also known as material jetting, has emerged as a transformative technology in the fabrication of microfluidic devices, offering unprecedented precision, material versatility, and design freedom. In 2025, several key technology trends are shaping the adoption and evolution of polymer jetting for microfluidics, driven by the increasing demand for rapid prototyping, complex geometries, and functional integration in biomedical, chemical, and analytical applications.

- Multi-Material Printing and Functional Integration: Recent advances in polymer jetting systems enable simultaneous deposition of multiple photopolymers, allowing for the integration of rigid, flexible, and even biocompatible materials within a single microfluidic device. This capability supports the fabrication of devices with embedded valves, sensors, and optical elements, streamlining the development of lab-on-a-chip platforms. Companies such as Stratasys and 3D Systems have introduced printers capable of high-resolution, multi-material jetting, which is particularly advantageous for prototyping and low-volume production of complex microfluidic architectures.

- Resolution and Surface Quality Improvements: The latest polymer jetting printers achieve feature resolutions below 20 microns, with surface roughness values suitable for microfluidic channel fabrication. Enhanced printhead technology and optimized photopolymer formulations have reduced channel clogging and improved the fidelity of intricate internal features, as reported by IDTechEx. These improvements are critical for ensuring laminar flow and precise fluid control in microfluidic applications.

- Post-Processing Automation: Automated post-processing solutions, including support material removal and UV curing, are being integrated into polymer jetting workflows. This reduces manual labor, shortens turnaround times, and enhances reproducibility, which is essential for both research and commercial production environments. Formlabs and other industry players are investing in end-to-end solutions that streamline the transition from digital design to functional microfluidic device.

- Material Innovation and Biocompatibility: The development of new photopolymers with improved chemical resistance, optical transparency, and biocompatibility is expanding the application scope of polymer jetting in microfluidics. According to SmarTech Analysis, the availability of certified materials for medical and analytical use is a key driver for adoption in regulated industries.

These trends collectively position polymer jetting as a leading technology for next-generation microfluidic device fabrication, enabling rapid innovation and customization in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for polymer jetting 3D printing in microfluidic device fabrication is characterized by a mix of established additive manufacturing companies, specialized microfluidics firms, and emerging startups. As of 2025, the market is witnessing increased activity due to the growing demand for rapid prototyping, high-resolution features, and the ability to fabricate complex microchannel geometries that traditional manufacturing methods struggle to achieve.

Key players in the polymer jetting segment include Stratasys Ltd., which has been a pioneer in PolyJet technology. Stratasys’ systems, such as the J8 series, are widely adopted in research and commercial settings for producing microfluidic prototypes with multi-material capabilities and sub-50 micron resolution. Another significant player is 3D Systems, Inc., whose MultiJet Printing (MJP) technology is leveraged for its fine feature resolution and smooth surface finishes, both critical for microfluidic applications.

Emerging companies are also making notable contributions. Carima and EnvisionTEC (now part of Desktop Metal) have introduced high-precision jetting systems tailored for microfluidics, focusing on biocompatible and transparent materials. These companies are targeting academic and industrial R&D labs that require rapid iteration and functional testing of microfluidic chips.

In addition to hardware providers, material suppliers such as Dow and DuPont are collaborating with printer manufacturers to develop photopolymers optimized for microfluidic device fabrication, addressing challenges like chemical resistance and optical clarity.

- Strategic Partnerships: There is a trend toward partnerships between 3D printer manufacturers and microfluidics research institutes, such as the collaboration between Stratasys Ltd. and the Wyss Institute at Harvard, aimed at advancing functional microfluidic device prototyping.

- Regional Activity: North America and Europe remain the leading regions, with significant investments in healthcare, diagnostics, and life sciences driving adoption. However, Asia-Pacific is rapidly catching up, with companies like Asiga expanding their presence in the region.

- Market Differentiation: Leading players differentiate through print resolution, material portfolio, and software integration for design automation and simulation, which are crucial for microfluidic device performance.

Overall, the competitive landscape in 2025 is dynamic, with established leaders consolidating their positions through innovation and partnerships, while agile startups push the boundaries of material science and application-specific solutions in polymer jetting for microfluidics.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global market for polymer jetting 3D printing in microfluidic device fabrication is poised for robust expansion between 2025 and 2030, driven by increasing demand for rapid prototyping, customization, and high-resolution manufacturing in biomedical and analytical applications. According to recent industry analyses, the market size for polymer jetting 3D printing in microfluidics is projected to reach approximately USD 180–220 million by 2025, with expectations to surpass USD 500 million by 2030, reflecting a compound annual growth rate (CAGR) of 21–24% during the forecast period MarketsandMarkets, IDTechEx.

This growth is underpinned by several key factors:

- Technological Advancements: Ongoing improvements in printhead precision, material compatibility, and multi-material jetting are enabling the fabrication of complex, high-fidelity microfluidic structures, which is expanding the addressable market for polymer jetting technologies SmarTech Analysis.

- Healthcare and Life Sciences Demand: The surge in point-of-care diagnostics, organ-on-chip research, and personalized medicine is fueling the adoption of microfluidic devices, with polymer jetting offering the speed and design flexibility required for rapid iteration and low-volume production Grand View Research.

- Cost and Time Efficiency: Compared to traditional manufacturing, polymer jetting significantly reduces lead times and tooling costs, making it attractive for both academic research and commercial product development.

Regionally, North America and Europe are expected to maintain leading market shares due to strong R&D ecosystems and early adoption of advanced manufacturing technologies. However, Asia-Pacific is anticipated to exhibit the fastest CAGR, propelled by expanding investments in biotechnology and healthcare infrastructure Fortune Business Insights.

In summary, the polymer jetting 3D printing segment for microfluidic device fabrication is set for dynamic growth from 2025 to 2030, with a projected CAGR exceeding 20%. This trajectory is supported by technological innovation, expanding application scope, and the growing need for agile, high-precision manufacturing in the microfluidics sector.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The regional market landscape for polymer jetting 3D printing in microfluidic device fabrication is shaped by varying levels of technological adoption, research activity, and industrial demand across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- North America: North America, particularly the United States, leads the market due to its robust R&D ecosystem, strong presence of 3D printing technology providers, and significant investments in life sciences and healthcare. The region benefits from collaborations between academic institutions and industry, driving innovation in microfluidic device prototyping and production. According to SmarTech Analysis, North America accounted for over 35% of the global 3D printing market in 2024, with polymer jetting technologies gaining traction in biomedical applications.

- Europe: Europe is a key player, with countries like Germany, the UK, and the Netherlands at the forefront of microfluidics research and additive manufacturing. The European Union’s funding initiatives, such as Horizon Europe, support the integration of advanced 3D printing in medical device development. The region’s emphasis on regulatory compliance and quality standards has fostered the adoption of polymer jetting for producing high-precision, biocompatible microfluidic devices. European Bioplastics reports increasing use of photopolymer materials in microfluidics, further boosting the market.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid growth, driven by expanding healthcare infrastructure, rising investments in biotechnology, and government support for advanced manufacturing. China, Japan, and South Korea are leading adopters, with local companies and research institutes actively developing polymer jetting solutions for lab-on-a-chip and diagnostic devices. According to IDTechEx, Asia-Pacific’s share of the 3D printing market is expected to surpass 30% by 2025, with microfluidics representing a high-growth segment.

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, adoption remains nascent but is gradually increasing. Growth is supported by international collaborations, technology transfer, and the need for affordable, rapid prototyping solutions in healthcare and environmental monitoring. Initiatives by organizations like the World Health Organization to promote point-of-care diagnostics are expected to stimulate demand for microfluidic devices fabricated via polymer jetting.

Overall, while North America and Europe currently dominate, Asia-Pacific is poised for the fastest growth, and RoW regions are emerging as new markets for polymer jetting 3D printing in microfluidic device fabrication in 2025.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the future of polymer jetting 3D printing in microfluidic device fabrication is marked by rapid technological evolution and expanding commercial interest. The convergence of high-resolution additive manufacturing and the growing demand for miniaturized, customizable fluidic systems is driving both research and investment in this sector.

Emerging applications are particularly prominent in the biomedical and life sciences fields. Polymer jetting enables the fabrication of complex, multi-material microfluidic devices with integrated functionalities, such as embedded sensors, valves, and optical elements. This capability is accelerating the development of lab-on-a-chip platforms for diagnostics, drug screening, and organ-on-chip models, which are increasingly sought after by pharmaceutical companies and research institutions. For example, the integration of polymer jetting with biocompatible resins is facilitating the direct printing of devices suitable for cell culture and point-of-care testing, a trend highlighted in recent industry analyses by SmarTech Analysis.

Another emerging application is in chemical synthesis and environmental monitoring, where the ability to rapidly prototype and iterate microfluidic designs is crucial. The flexibility of polymer jetting allows for the creation of intricate channel geometries and surface modifications, supporting the development of next-generation analytical devices. Companies such as Stratasys and 3D Systems are investing in new printhead technologies and resin formulations to address these specialized requirements.

From an investment perspective, hotspots are forming around startups and established players that offer end-to-end solutions for microfluidic device design, printing, and post-processing. Venture capital is flowing into companies that can demonstrate scalable manufacturing workflows and regulatory compliance, particularly for medical and diagnostic applications. According to IDTechEx, the market for 3D-printed microfluidic devices is expected to grow at a double-digit CAGR through 2025, with polymer jetting technologies capturing a significant share due to their precision and versatility.

In summary, the future outlook for polymer jetting 3D printing in microfluidic device fabrication is characterized by expanding application domains, ongoing material and process innovation, and robust investment activity. As the technology matures, it is poised to become a cornerstone of rapid, customized microfluidic device production across multiple high-value sectors.

Challenges, Risks, and Strategic Opportunities

Polymer jetting 3D printing, also known as material jetting, has emerged as a promising technology for the fabrication of microfluidic devices due to its high resolution, multi-material capabilities, and smooth surface finishes. However, the adoption of polymer jetting in this niche faces several challenges and risks, while also presenting strategic opportunities for stakeholders in 2025.

One of the primary challenges is the limited range of printable materials that are both biocompatible and chemically resistant, which are essential for many microfluidic applications in life sciences and diagnostics. While leading manufacturers such as Stratasys and 3D Systems have expanded their material portfolios, the selection remains narrow compared to traditional manufacturing methods. This limitation can restrict the functional performance and application scope of 3D-printed microfluidic devices.

Another significant risk is the high cost of polymer jetting equipment and proprietary resins. The initial capital investment and ongoing material expenses can be prohibitive for startups and academic labs, potentially slowing broader adoption. Additionally, the intellectual property landscape is complex, with key patents held by major players, which may pose legal risks or barriers to entry for new market entrants (IDTechEx).

Technical challenges also persist, particularly in achieving truly leak-proof, monolithic microfluidic channels at the sub-100-micron scale. Issues such as incomplete curing, surface roughness at the microscale, and post-processing requirements can impact device reliability and throughput (Nature Scientific Reports).

Despite these hurdles, strategic opportunities abound. The growing demand for rapid prototyping and low-volume production of custom microfluidic devices in research, point-of-care diagnostics, and drug discovery is driving interest in polymer jetting. The technology’s ability to integrate multiple materials and functional elements in a single build opens avenues for next-generation lab-on-a-chip devices. Partnerships between 3D printer manufacturers and specialty resin developers, as well as collaborations with academic and clinical research centers, are expected to accelerate innovation and address current material and technical gaps (SmarTech Analysis).

In summary, while polymer jetting 3D printing for microfluidic device fabrication faces material, cost, and technical challenges, the sector is poised for growth as new materials, improved printer architectures, and collaborative innovation strategies emerge in 2025.

Sources & References

- SmarTech Analysis

- Stratasys

- 3D Systems

- IDTechEx

- Formlabs

- DuPont

- Wyss Institute at Harvard

- Asiga

- MarketsandMarkets

- Grand View Research

- Fortune Business Insights

- European Bioplastics

- World Health Organization

- Nature Scientific Reports