Ultraviolet Photolithography Equipment Manufacturing in 2025: Navigating Explosive Growth and Pioneering Innovations. Discover How Next-Gen Lithography is Shaping the Semiconductor Industry’s Future.

- Executive Summary: 2025 Market Overview and Key Drivers

- Global Market Size, Growth Rate, and 2025–2030 Forecasts

- Technological Advancements: Deep UV (DUV) vs. Extreme UV (EUV)

- Key Players and Competitive Landscape (e.g., asml.com, canon.com, nikon.com)

- Supply Chain Dynamics and Critical Component Sourcing

- Emerging Applications in Semiconductor Fabrication

- Regulatory Environment and Industry Standards (e.g., sematech.org, ieee.org)

- Regional Analysis: Asia-Pacific, North America, and Europe Trends

- Challenges: Cost, Complexity, and Talent Shortages

- Future Outlook: Innovation Roadmap and Strategic Opportunities

- Sources & References

Executive Summary: 2025 Market Overview and Key Drivers

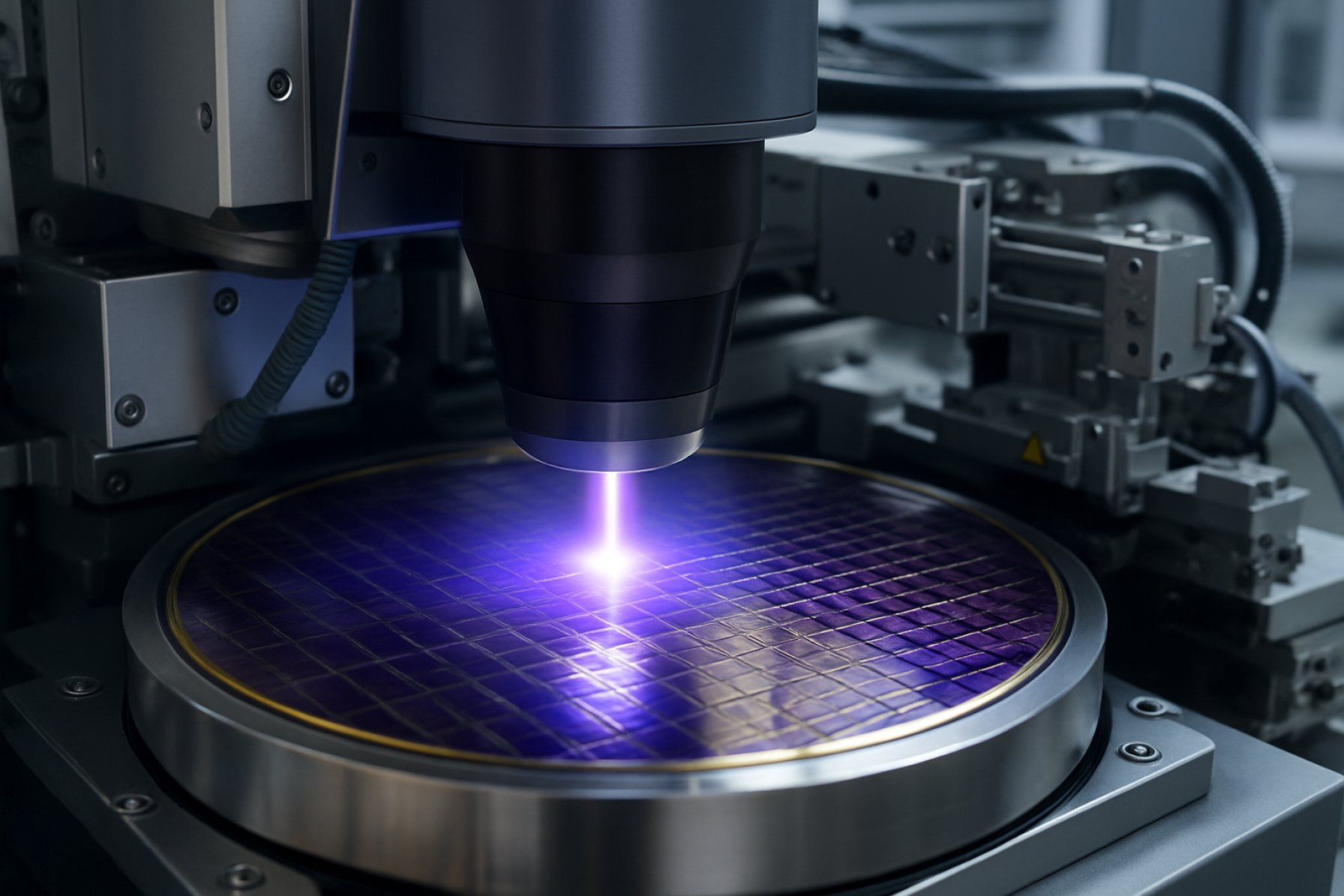

The ultraviolet (UV) photolithography equipment manufacturing sector is poised for continued growth and transformation in 2025, driven by the relentless demand for advanced semiconductor devices and the ongoing evolution of chip fabrication technologies. UV photolithography, encompassing both deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems, remains a cornerstone of integrated circuit (IC) production, enabling the miniaturization and complexity required for next-generation electronics.

In 2025, the market is characterized by robust investments from leading semiconductor foundries and integrated device manufacturers (IDMs) seeking to expand capacity and transition to more advanced process nodes. The push towards sub-5nm and even 3nm nodes is intensifying, with EUV lithography playing a critical role. ASML Holding NV continues to dominate the EUV equipment segment, supplying the majority of high-volume manufacturing systems to top-tier chipmakers. The company’s EUV platforms are essential for patterning the smallest features, and its DUV systems remain vital for multiple patterning and mature node production.

Japanese manufacturers such as Nikon Corporation and Canon Inc. maintain significant positions in the DUV photolithography market, providing advanced immersion and dry lithography tools. These companies are focusing on enhancing throughput, overlay accuracy, and cost efficiency to support both leading-edge and legacy semiconductor manufacturing. Their equipment is widely adopted in memory, logic, and specialty device fabrication worldwide.

Key drivers shaping the 2025 landscape include the proliferation of artificial intelligence (AI), 5G, automotive electronics, and the Internet of Things (IoT), all of which require increasingly sophisticated chips. The global race for semiconductor self-sufficiency, particularly in the United States, Europe, and East Asia, is spurring new fab construction and equipment procurement. Government incentives and strategic partnerships are accelerating the deployment of advanced photolithography tools in both established and emerging markets.

Looking ahead, the UV photolithography equipment sector is expected to see continued innovation, with manufacturers investing in higher numerical aperture (NA) EUV systems, improved resist materials, and advanced metrology solutions. Supply chain resilience and the ability to scale production capacity will be critical as demand remains strong. The competitive landscape will likely remain concentrated among a handful of technology leaders, with ASML Holding NV, Nikon Corporation, and Canon Inc. at the forefront of enabling the next wave of semiconductor advancements.

Global Market Size, Growth Rate, and 2025–2030 Forecasts

The global ultraviolet (UV) photolithography equipment manufacturing sector is a cornerstone of the semiconductor industry, enabling the mass production of integrated circuits and advanced microelectronics. As of 2025, the market is experiencing robust growth, driven by escalating demand for high-performance chips in applications such as artificial intelligence, 5G, automotive electronics, and consumer devices. The sector is characterized by a high degree of technological sophistication and a concentrated competitive landscape, with a handful of major players dominating global supply.

The market size for UV photolithography equipment—including both deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems—is estimated to exceed tens of billions of US dollars in 2025. This growth is underpinned by continued investment in semiconductor fabrication plants (fabs) worldwide, particularly in Asia-Pacific regions such as Taiwan, South Korea, and China, as well as significant capacity expansions in the United States and Europe. The demand for advanced DUV and EUV tools is especially strong among leading-edge foundries and integrated device manufacturers (IDMs).

Among the key manufacturers, ASML Holding NV stands as the undisputed global leader in EUV photolithography, supplying the majority of the world’s most advanced lithography systems. ASML’s EUV platforms are essential for producing chips at the 7nm process node and below, and the company continues to ramp up production capacity to meet surging demand. In the DUV segment, Nikon Corporation and Canon Inc. are prominent suppliers, providing critical immersion and dry lithography systems for a wide range of semiconductor manufacturing applications.

Looking ahead to 2030, the UV photolithography equipment market is projected to maintain a strong compound annual growth rate (CAGR), with estimates commonly ranging from 7% to 10% per year. This expansion is fueled by the ongoing miniaturization of semiconductor devices, the proliferation of advanced packaging technologies, and the increasing complexity of chip architectures. The transition to high-NA (numerical aperture) EUV systems, spearheaded by ASML Holding NV, is expected to further accelerate market growth by enabling even smaller feature sizes and higher chip densities.

- Asia-Pacific will remain the largest and fastest-growing regional market, driven by investments from major foundries and government-backed semiconductor initiatives.

- North America and Europe are expected to see renewed growth due to strategic efforts to localize semiconductor manufacturing and reduce supply chain vulnerabilities.

- Technological barriers, high capital costs, and supply chain constraints—especially for critical components such as optics and light sources—will continue to shape the competitive dynamics of the industry.

In summary, the ultraviolet photolithography equipment manufacturing market is poised for sustained expansion through 2030, underpinned by relentless innovation, strategic investments, and the indispensable role of photolithography in the global semiconductor value chain.

Technological Advancements: Deep UV (DUV) vs. Extreme UV (EUV)

The ultraviolet photolithography equipment manufacturing sector is experiencing rapid technological evolution, primarily driven by the ongoing transition from Deep Ultraviolet (DUV) to Extreme Ultraviolet (EUV) lithography. As of 2025, DUV lithography—utilizing wavelengths of 193 nm (ArF) and 248 nm (KrF)—remains the backbone of semiconductor fabrication for nodes above 7 nm. However, the relentless demand for higher transistor densities and energy efficiency is accelerating the adoption of EUV lithography, which operates at a much shorter wavelength of 13.5 nm, enabling patterning at the 5 nm node and beyond.

The market for DUV equipment continues to be robust, with leading manufacturers such as ASML Holding NV, Nikon Corporation, and Canon Inc. supplying advanced immersion and dry DUV scanners. These systems are essential for both leading-edge and mature process nodes, with ongoing enhancements in overlay accuracy, throughput, and cost of ownership. For instance, ASML Holding NV’s TWINSCAN NXT series remains a workhorse for high-volume manufacturing, while Nikon Corporation and Canon Inc. continue to innovate in multi-patterning and overlay control.

EUV lithography, however, is at the forefront of technological advancement. ASML Holding NV is the sole supplier of high-volume EUV scanners, with its NXE and EXE series enabling sub-5 nm production. In 2025, the company is ramping up shipments of its latest EXE:5000 platform, which supports High-NA (Numerical Aperture) EUV, a critical step for 2 nm and future nodes. The complexity of EUV systems—requiring ultra-high vacuum, advanced light sources, and defect-free photomasks—has led to significant collaboration with suppliers such as Carl Zeiss AG (optics) and Cymer (light sources, a subsidiary of ASML).

Looking ahead, the next few years will see DUV and EUV technologies coexisting, with DUV remaining vital for cost-sensitive and legacy applications, while EUV adoption expands for advanced logic and memory. The introduction of High-NA EUV is expected to further push the limits of miniaturization, though challenges in mask defectivity, resist sensitivity, and system cost persist. Equipment manufacturers are investing heavily in R&D to address these hurdles, with ASML Holding NV projecting continued growth in EUV system demand through 2027 and beyond.

- DUV: Dominant for mature nodes, ongoing improvements in throughput and overlay.

- EUV: Essential for sub-5 nm, High-NA EUV to enable 2 nm and beyond.

- Key players: ASML Holding NV, Nikon Corporation, Canon Inc., Carl Zeiss AG, Cymer.

- Outlook: DUV and EUV to coexist, with EUV’s share rising as technical and economic barriers are addressed.

Key Players and Competitive Landscape (e.g., asml.com, canon.com, nikon.com)

The ultraviolet (UV) photolithography equipment manufacturing sector is characterized by a highly concentrated competitive landscape, with a small number of global players dominating the market. As of 2025, the industry is led by three principal companies: ASML Holding NV, Canon Inc., and Nikon Corporation. These firms are responsible for the vast majority of advanced photolithography systems used in semiconductor fabrication worldwide.

ASML Holding NV, headquartered in the Netherlands, is the undisputed leader in the photolithography equipment market, particularly in the extreme ultraviolet (EUV) and deep ultraviolet (DUV) segments. ASML’s DUV systems, such as the TWINSCAN NXT and XT series, remain the backbone of high-volume chip manufacturing, supporting nodes from mature 200mm lines to advanced 5nm and below. The company’s robust supply chain, extensive R&D investment, and close collaboration with leading chipmakers like TSMC, Samsung, and Intel have solidified its position. In 2025, ASML continues to expand its DUV portfolio, focusing on productivity enhancements and cost efficiency to address both leading-edge and legacy node demand.

Canon Inc. of Japan is a major supplier of i-line and KrF DUV steppers and scanners, serving both advanced and mature semiconductor manufacturing. Canon’s photolithography systems are widely adopted for specialty applications, including image sensors, power devices, and MEMS. The company’s focus on flexibility and cost-effective solutions has enabled it to maintain a strong presence in the mid-range and specialty device markets. Canon is also investing in new system architectures to improve overlay accuracy and throughput, aiming to capture opportunities in the growing automotive and IoT chip sectors.

Nikon Corporation, also based in Japan, is another key player, offering a comprehensive range of DUV lithography equipment. Nikon’s latest NSR series scanners are designed for both advanced logic and memory production, as well as for mature process nodes. The company is recognized for its precision optics and alignment technologies, which are critical for high-yield semiconductor manufacturing. In 2025, Nikon is focusing on enhancing system productivity and supporting the transition to smaller nodes, while also catering to the demand for legacy node capacity.

The competitive landscape is further shaped by the high barriers to entry, including the need for advanced optical engineering, precision manufacturing, and long-term customer relationships. While emerging players and regional initiatives—particularly in China—are attempting to develop indigenous photolithography capabilities, the technological gap remains significant. Over the next few years, the market is expected to remain consolidated, with ASML Holding NV, Canon Inc., and Nikon Corporation retaining their leadership through continuous innovation and strategic partnerships.

Supply Chain Dynamics and Critical Component Sourcing

The supply chain for ultraviolet (UV) photolithography equipment manufacturing is characterized by its complexity and reliance on a tightly integrated network of global suppliers. As of 2025, the sector is experiencing both opportunities and challenges driven by technological advancements, geopolitical factors, and evolving demand from the semiconductor industry.

Key components for UV photolithography systems include high-precision optics, excimer lasers, advanced photoresists, and ultra-clean mechanical assemblies. The manufacturing of these systems is dominated by a small number of highly specialized companies. ASML Holding NV remains the world’s leading supplier of photolithography equipment, particularly for deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems. ASML’s supply chain encompasses hundreds of suppliers, with critical components such as high-numerical-aperture lenses sourced from Carl Zeiss AG, and excimer lasers provided by Cymer (a subsidiary of ASML Holding NV).

The supply chain is highly sensitive to disruptions, as many components require ultra-high purity and precision manufacturing. For example, the production of photomasks and photoresists involves companies like Tokyo Ohka Kogyo Co., Ltd. and JSR Corporation, both of which are critical for ensuring the quality and resolution of UV lithography processes. The need for contamination-free environments and specialized materials further complicates logistics and sourcing.

Recent years have seen increased efforts to localize and diversify supply chains, particularly in response to geopolitical tensions and export controls affecting semiconductor equipment. The United States, European Union, Japan, and South Korea are all investing in domestic capabilities to reduce reliance on single-source suppliers and mitigate risks. For instance, Nikon Corporation and Canon Inc. continue to develop their own DUV photolithography systems, contributing to a more distributed supply base.

Looking ahead, the outlook for UV photolithography equipment supply chains in the next few years is shaped by ongoing investments in capacity expansion, supplier qualification, and risk management. The industry is expected to see increased collaboration between equipment manufacturers and material suppliers to ensure resilience and meet the stringent requirements of next-generation semiconductor nodes. However, the high barriers to entry and the technical complexity of critical components mean that the supply chain will likely remain concentrated among a handful of leading firms, with incremental diversification as a strategic priority.

Emerging Applications in Semiconductor Fabrication

Ultraviolet (UV) photolithography equipment remains a cornerstone of semiconductor fabrication, with its evolution closely tied to the industry’s relentless pursuit of smaller, more efficient, and higher-performing integrated circuits. As of 2025, the sector is witnessing significant momentum driven by both established and emerging applications, particularly in advanced logic, memory, and specialty device manufacturing.

Deep ultraviolet (DUV) photolithography, utilizing wavelengths such as 248 nm (KrF) and 193 nm (ArF), continues to be widely deployed for critical patterning steps in nodes ranging from mature 90 nm down to 7 nm, especially where extreme ultraviolet (EUV) is not yet cost-effective or available. Leading equipment manufacturers such as ASML Holding NV, Canon Inc., and Nikon Corporation dominate the global market, supplying advanced DUV steppers and scanners to foundries and integrated device manufacturers (IDMs) worldwide.

In 2025, the demand for UV photolithography equipment is being propelled by several emerging applications:

- Heterogeneous Integration and Advanced Packaging: The rise of chiplet architectures and 2.5D/3D packaging is increasing the need for high-precision DUV lithography tools capable of handling larger substrates and complex alignment requirements. Companies like ASML Holding NV are expanding their product lines to address these advanced packaging needs.

- Power and Compound Semiconductors: The growth in electric vehicles, renewable energy, and 5G infrastructure is driving investments in silicon carbide (SiC) and gallium nitride (GaN) device fabrication. UV photolithography equipment is being adapted for these materials, with manufacturers such as Canon Inc. and Nikon Corporation offering specialized systems for wide bandgap semiconductors.

- Specialty and More-than-Moore Devices: Applications in MEMS, sensors, and RF devices continue to rely on mature DUV lithography platforms, ensuring sustained demand for equipment upgrades and refurbishment.

Looking ahead, the outlook for UV photolithography equipment manufacturing remains robust. While EUV is increasingly adopted for leading-edge nodes, DUV systems are expected to retain a critical role in both volume production and emerging specialty applications. Equipment makers are investing in higher throughput, improved overlay accuracy, and lower cost of ownership to meet the evolving requirements of semiconductor fabs. Additionally, the global push for supply chain resilience and regional manufacturing is prompting new fab investments in North America, Europe, and Asia, further supporting demand for advanced UV photolithography tools from industry leaders such as ASML Holding NV, Canon Inc., and Nikon Corporation.

Regulatory Environment and Industry Standards (e.g., sematech.org, ieee.org)

The regulatory environment and industry standards for ultraviolet (UV) photolithography equipment manufacturing are evolving rapidly in 2025, reflecting both technological advancements and the increasing complexity of semiconductor fabrication. Regulatory oversight and standardization are critical to ensuring equipment interoperability, process reliability, and safety across the global supply chain.

Key industry standards are developed and maintained by organizations such as the IEEE and SEMI (Semiconductor Equipment and Materials International). The IEEE sets technical standards for photolithography systems, including protocols for electromagnetic compatibility, safety, and performance. Meanwhile, SEMI provides guidelines for equipment interfaces, cleanliness, and material compatibility, which are essential for the integration of UV photolithography tools into advanced semiconductor fabs.

In 2025, regulatory focus has intensified on environmental and occupational safety, particularly regarding the use of hazardous chemicals and high-intensity UV sources. Equipment manufacturers such as ASML Holding and Canon Inc. are required to comply with international safety standards, including those related to laser and UV radiation exposure, as well as the handling and disposal of photoresists and etchants. Compliance with the Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation is now standard practice for equipment shipped to the European Union and other major markets.

The industry is also responding to the growing demand for traceability and data integrity in manufacturing processes. Standards for equipment data interfaces, such as SEMI’s EDA/Interface A, are being widely adopted to enable real-time monitoring and predictive maintenance of photolithography tools. This is particularly relevant as leading-edge fabs, operated by companies like TSMC and Samsung Electronics, push for higher yields and lower defect rates at sub-5nm nodes.

Looking ahead, the regulatory landscape is expected to become even more stringent as UV photolithography equipment incorporates new materials and higher energy sources, especially with the transition to extreme ultraviolet (EUV) lithography. Industry consortia, including SEMI and IEEE, are actively updating standards to address these challenges, ensuring that manufacturers can meet both current and future requirements for safety, interoperability, and environmental stewardship.

Regional Analysis: Asia-Pacific, North America, and Europe Trends

The ultraviolet (UV) photolithography equipment manufacturing sector is experiencing dynamic regional trends across Asia-Pacific, North America, and Europe as of 2025, with each region leveraging its unique strengths and responding to evolving semiconductor industry demands.

Asia-Pacific remains the global epicenter for semiconductor manufacturing, driving the largest demand for UV photolithography equipment. Countries such as Taiwan, South Korea, Japan, and increasingly China, are home to leading foundries and integrated device manufacturers (IDMs). Taiwan Semiconductor Manufacturing Company (TSMC) continues to expand its advanced node production, necessitating significant investments in deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography tools. Samsung Electronics and SK Hynix in South Korea are similarly scaling up their memory and logic chip production, further fueling demand for state-of-the-art photolithography systems. Japan, with companies like Canon Inc. and Nikon Corporation, remains a key supplier of DUV lithography equipment, although these firms face intense competition from European counterparts in the EUV segment. China is rapidly investing in domestic capabilities, with state-backed initiatives supporting local equipment manufacturers and aiming to reduce reliance on foreign technology, though the country still depends heavily on imports for the most advanced photolithography systems.

North America is characterized by its leadership in photolithography equipment innovation and supply chain control. Applied Materials, Inc. and Lam Research Corporation are prominent U.S.-based suppliers of semiconductor manufacturing equipment, including photolithography process tools and supporting technologies. The region is also home to major chip designers and manufacturers, such as Intel Corporation, which is investing in new fabs and advanced process nodes, driving demand for next-generation UV lithography equipment. U.S. export controls and technology restrictions continue to shape the global competitive landscape, particularly affecting equipment flows to China and influencing regional supply chain strategies.

Europe is distinguished by its dominance in the most advanced photolithography technology. ASML Holding NV, headquartered in the Netherlands, is the world’s sole supplier of EUV lithography systems, which are essential for leading-edge semiconductor manufacturing. ASML’s equipment is integral to the production lines of top foundries and IDMs worldwide, and the company is expanding its capacity to meet surging global demand. European suppliers also play a critical role in the photolithography ecosystem, providing precision optics, light sources, and metrology tools. Regional policy initiatives, such as the European Chips Act, are supporting further investment in semiconductor manufacturing and equipment development, aiming to bolster Europe’s strategic autonomy in this sector.

Looking ahead, the Asia-Pacific region is expected to maintain its manufacturing dominance, while North America and Europe will continue to lead in equipment innovation and supply chain resilience. Geopolitical factors, government incentives, and ongoing technological advancements will shape the competitive landscape of UV photolithography equipment manufacturing through the next several years.

Challenges: Cost, Complexity, and Talent Shortages

Ultraviolet photolithography equipment manufacturing faces a confluence of challenges in 2025, with cost, complexity, and talent shortages emerging as persistent barriers to growth and innovation. The capital intensity of developing and producing advanced photolithography systems—especially those supporting deep ultraviolet (DUV) and extreme ultraviolet (EUV) processes—remains a defining feature of the industry. Leading manufacturers such as ASML Holding, Canon Inc., and Nikon Corporation invest billions of euros and yen annually in R&D and production infrastructure to keep pace with the ever-shrinking process nodes demanded by semiconductor foundries.

The complexity of ultraviolet photolithography equipment is escalating as device geometries approach the sub-5nm regime. EUV systems, for example, require highly specialized components such as multi-layer mirrors, high-power light sources, and sophisticated vacuum environments. The supply chain for these components is both global and fragile, with only a handful of suppliers capable of meeting the stringent quality and precision requirements. ASML Holding—the sole supplier of EUV lithography systems—relies on critical partners for key subsystems, including Carl Zeiss AG for optics and Cymer (a subsidiary of ASML Holding) for light sources. Any disruption in this tightly coupled ecosystem can lead to significant production delays and cost overruns.

Cost pressures are further exacerbated by the need for continuous innovation. The average price of a state-of-the-art EUV scanner now exceeds $150 million per unit, with total cost of ownership rising due to maintenance, upgrades, and the need for highly trained service personnel. This high barrier to entry limits the number of companies able to participate in the market, concentrating technological leadership among a few players and making the industry vulnerable to geopolitical and supply chain risks.

Talent shortages represent another acute challenge. The photolithography sector requires a workforce with deep expertise in optics, precision engineering, materials science, and software. However, the global pool of such specialists is limited, and competition for talent is fierce. Companies like ASML Holding and Nikon Corporation have launched aggressive recruitment and training initiatives, but the pipeline of qualified engineers and technicians is not keeping pace with demand. This talent gap threatens to slow innovation and could constrain the industry’s ability to scale production in response to surging demand for advanced semiconductors.

Looking ahead, the ultraviolet photolithography equipment manufacturing sector must navigate these intertwined challenges to sustain progress. Addressing cost and complexity will require continued collaboration across the supply chain, while investment in education and workforce development is essential to mitigate talent shortages. The next few years will be pivotal in determining whether the industry can maintain its trajectory of technological advancement and meet the needs of a rapidly evolving semiconductor landscape.

Future Outlook: Innovation Roadmap and Strategic Opportunities

The ultraviolet (UV) photolithography equipment manufacturing sector is poised for significant transformation in 2025 and the coming years, driven by the relentless demand for advanced semiconductor devices and the ongoing evolution of chip fabrication technologies. As the industry approaches the physical and economic limits of deep ultraviolet (DUV) lithography, innovation is increasingly focused on both extending the capabilities of existing UV platforms and accelerating the transition to next-generation solutions.

Key industry leaders such as ASML Holding NV, Canon Inc., and Nikon Corporation continue to dominate the global photolithography equipment market. ASML remains the primary supplier of extreme ultraviolet (EUV) systems, but also maintains a robust portfolio of DUV equipment, which is still essential for many critical layers in advanced semiconductor manufacturing. Canon and Nikon are also investing in DUV and multi-patterning technologies to extend the lifespan and performance of UV-based lithography.

In 2025, the strategic focus is on enhancing throughput, overlay accuracy, and cost efficiency. Equipment manufacturers are integrating advanced optics, improved light sources, and AI-driven process control to push the limits of resolution and yield. For example, Nikon has announced ongoing R&D in ArF immersion scanners, targeting sub-5nm nodes, while Canon is developing new KrF and ArF lithography platforms to address both leading-edge and mature process nodes.

The outlook for the next few years includes a dual-track innovation roadmap: (1) maximizing the utility of DUV systems through multi-patterning, advanced resist materials, and computational lithography, and (2) supporting the industry’s gradual migration to EUV and, eventually, high-NA EUV systems. This transition is expected to be gradual, as the high cost and complexity of EUV adoption mean that DUV will remain indispensable for many applications, including memory, logic, and specialty semiconductors.

Strategic opportunities are emerging in the development of modular, upgradable equipment platforms, enabling fabs to adapt to evolving process requirements without full system replacement. Additionally, partnerships between equipment makers and semiconductor foundries are intensifying, with joint development programs aimed at co-optimizing hardware and process recipes for next-generation nodes.

Overall, the UV photolithography equipment manufacturing sector in 2025 is characterized by a blend of incremental innovation and bold strategic bets, as industry leaders position themselves to meet the demands of a rapidly evolving semiconductor landscape while navigating the technical and economic challenges of next-generation lithography.

Sources & References

- ASML Holding NV

- Nikon Corporation

- Canon Inc.

- Carl Zeiss AG

- Tokyo Ohka Kogyo Co., Ltd.

- JSR Corporation

- IEEE

- SK Hynix